In 2025, with inflation rising and the economy full of unknowns, the old “save three to six months of expenses in cash” rule needs an update.

While an emergency fund or savings account is still essential, keeping it all in a low-interest savings account is no longer the smartest move.

Personally, I’ve adopted a more strategic approach: I keep a very lean and accessible emergency fund and diversify the rest across assets that can grow, hedge inflation, and provide income.

Key Takeaways

- Don’t over-pile cash. Keep just enough for emergencies in a flexible, higher-yield account—not a stagnant savings account.

- Diversify excess into stocks, bonds, REITs, gold, and crypto to hedge inflation and build long-term wealth.

- Use tools like SoFi Invest or Webull to automate and manage your portfolio.

- Make sure your investments align with your risk tolerance and long-term goals.

This post may contain affiliate links. We may earn a small commission at no extra cost to you. Some links may come with a promotional offer. Using these links helps support our content and keeps it free. Thank you!

The Problem With “Emergency Funds”

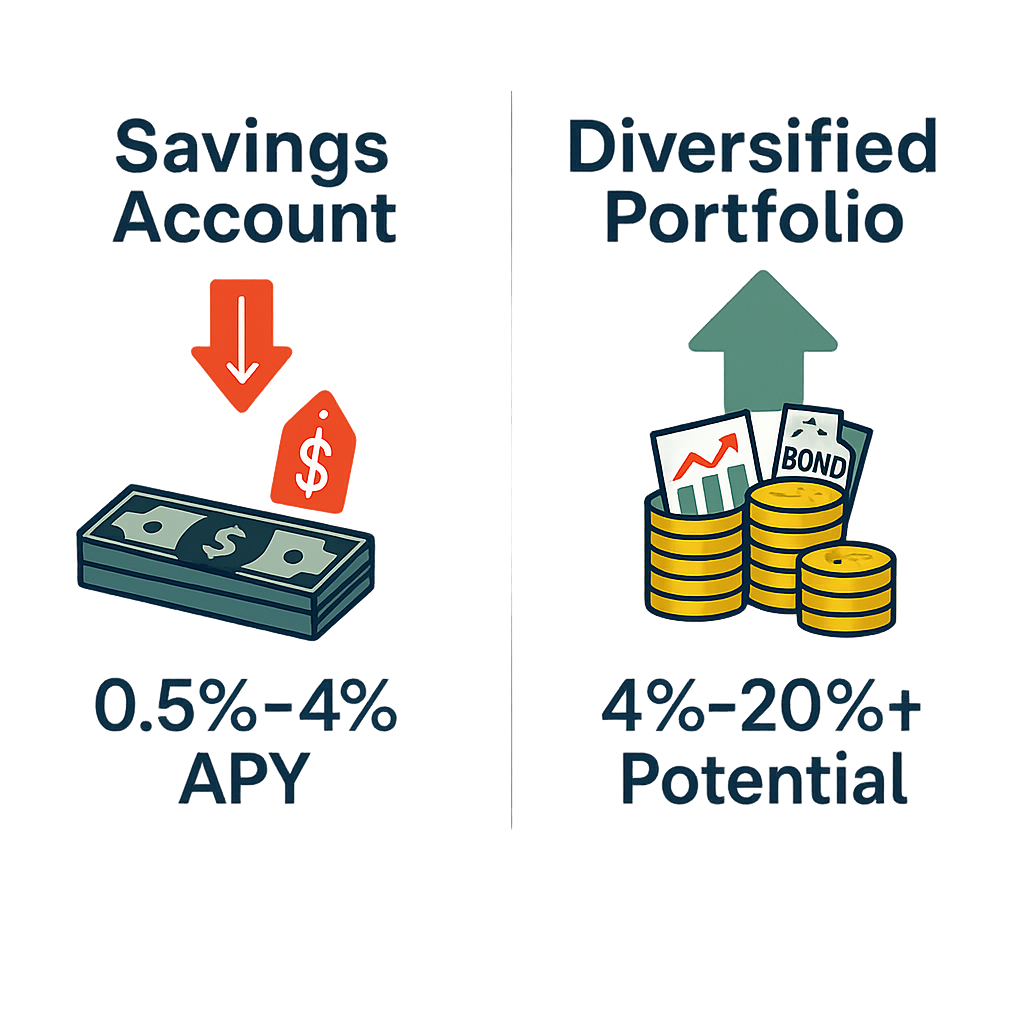

Traditional savings accounts typically pay between 0.5%–1.5% APY—far below inflation.

That means every dollar sitting in a savings account is quietly losing purchasing power. Even high-yield accounts struggle to keep up in today’s economy.

A better strategy is to keep just enough cash for urgent needs—but no more. Let the rest of your money “work for you”.

Diversification Strategies for 2025

Smart diversification spreads your risk across multiple asset types, protecting you when markets swing. But how do you know where to start?

Start by assessing your risk tolerance.

If market dips make you panic, you may want more bonds or REITs.

If you’re comfortable with long-term volatility, you might favor stocks or ETFs.

Align your strategy with your financial goals—like retirement, buying a home, or simply building passive income.

- Stocks & ETFs: Best for long-term growth. Start with broad funds like VTI or VOO.

- Bonds: Add stability. Treasury Inflation-Protected Securities (TIPS) adjust with inflation, helping your money retain its value.

- REITs: Real estate exposure without owning property. Try VNQ or SCHH.

- Gold & Commodities: Act as inflation hedges. Gold (via GLD) or commodity ETFs like DBC help diversify risk.

- Crypto: Limit to 1–5%. Use secure platforms like Coinbase or Crypto.com.

- Cash Alternatives: High-yield accounts like SoFi Money or CDs offer liquidity without total sacrifice of returns.

Platforms like SoFi Invest let you start investing with as little as $25—and you’ll get $25 in free stock when you do. Webull also offers free stocks and premium tools when you deposit.

Behavioral tip: Stay calm during market dips. Diversification smooths returns over time. Don’t panic—stick to your plan.

Assets: Saving vs Diversification

| Aspect | Traditional Savings | Diversified Portfolio |

|---|---|---|

| Returns | 0.5–1.5% APY | 4–10% (varies by allocation) |

| Inflation Protection | Low | High (TIPS, REITs, Gold) |

| Liquidity | Very High | Moderate |

| Risk | Very Low | Balanced with asset mix |

| Time Commitment | None | Minimal (automated with robo-advisors) |

Automated Investing with Robo-Advisors

Not everyone has time to analyze ETFs, rebalance portfolios, or monitor market news. That’s where robo-advisors come in.

These platforms use algorithms to build and manage a diversified portfolio tailored to your goals, risk level, and timeline.

Top benefits of robo-advisors:

- Hands-off investing — set your preferences and let it run

- Automated rebalancing and dividend reinvestment

- Low or no management fees on basic plans

- Risk profiling based on your age, goals, and comfort level

Get Started: Try SoFi Invest to get $25 in free stock, or get free stocks with Webull when you deposit.

Dividend Stocks & Income ETFs

Dividend-paying investments offer a powerful blend of growth and income.

Unlike savings interest, dividends can grow over time—and they often continue paying even during periods of market volatility.

They’re especially popular among long-term investors looking to supplement cash flow or reinvest for compounding returns.

- SDY: Tracks high-yield U.S. dividend-paying companies

- VIG: Focuses on dividend growth stocks with a consistent 10+ year track record

- JPEQ: Combines dividend yield with lower volatility (also a Smart Beta ETF)

While bonds offer fixed interest, dividend stocks and ETFs can provide a flexible and often growing income stream. Combining both in a portfolio gives you steady income with the potential for long-term appreciation.

Many dividend-focused ETFs automatically reinvest income, compounding your returns without extra effort. Others provide consistent payouts—ideal for retirement income or building a semi-passive income stream.

Understanding Bonds, CDs & Safer Income Tools

These low-volatility investments are ideal for conservative investors or as a stable portion of a diversified emergency fund alternative.

They won’t deliver massive gains, but they’re dependable and income-generating.

Types of Bonds to Know

- Treasury Bonds & TIPS: Issued by the U.S. government. TIPS adjust with inflation, protecting your purchasing power.

- Corporate Bonds: Offer higher returns with slightly more risk depending on issuer credit quality.

- Municipal Bonds: Tax-exempt income from state/local governments. Great for high-income earners.

ETFs like BND or AGG allow instant exposure to hundreds of bonds, simplifying access and reducing individual risk.

Certificates of Deposit (CDs)

CDs lock your money for a set term in exchange for a higher interest rate. They’re FDIC-insured and virtually risk-free.

Pro Tip: Laddering CDs with staggered maturity dates (e.g., 6, 12, 18 months) helps balance access and yield.

Smart Beta & Factor-Based ETFs

Traditional index funds are weighted by market size. Smart beta ETFs take a more strategic approach, targeting factors like value, momentum, dividends, or low volatility.

ETFs and bonds can typically be sold within 1–2 days for cash, balancing growth with accessibility.

- SPLV: Focuses on the lowest-volatility stocks in the S&P 500

- MTUM: Momentum-based ETF favoring stocks with recent performance strength

- JPEQ: Combines dividend yield with lower volatility screens

These ETFs offer a way to boost return potential or reduce risk—without having to stock pick.

Bonus Tip: Some Smart Beta ETFs like JPEQ also prioritize dividend-paying stocks, offering the benefit of income alongside stability. These ETFs can be a solid middle ground for conservative investors seeking both growth and cash flow.

International Diversification

Many portfolios are U.S.-heavy. Global exposure helps reduce country-specific risk and adds growth potential from developing markets.

- VXUS: Total international market (developed + emerging)

- VEU: Broad global exposure minus U.S.

- EMXC: Emerging markets ETF excluding China

International funds can zig while U.S. markets zag—providing more balance to your strategy.

Cryptocurrency

Crypto can be a powerful diversifier because it often moves independently from stocks and bonds.

But it’s volatile—and not for everyone.

Crypto is a long-term, high-risk diversifier, not a substitute for liquid emergency funds.

- Limit exposure to 1–5% of your total portfolio

- Stick with proven assets like Bitcoin, Ethereum, or Solana (The Big 3)

- Use secure platforms like Coinbase or Crypto.com

Crypto isn’t a replacement for traditional diversification—but it may complement it for investors comfortable with higher risk.

Use trusted platforms like Coinbase and Crypto.com. Coinbase gives you $30 in Bitcoin just for learning and signing up.

Recommended Platforms to Start Diversifying

- SoFi Invest – Start with just $25. Offers automated investing, active trades, and free stock promos.

- Webull – Earn bonus stocks and promotions with your deposit.

- Robinhood – Easy-to-use app, great for beginners. Offers fractional shares and crypto.

Frequently Asked Questions

Diversification Is Key.

Emergency funds still matter—but they should evolve.

Keeping everything in a single low-interest savings account is increasingly inefficient.

Diversification helps you protect, preserve, and grow your wealth while staying flexible and prepared.

Thanks for reading! If you found this helpful, like it, share it, and check out more of our content.