Most trading strategies require capital, risk tolerance, or deep technical knowledge; but not this one.

Reverse Stock Arbitrage (RSA) is a little-known tactic that lets traders earn consistent, almost risk-free profits from reverse stock splits, often with just a single share.

If you’ve never heard of RSA, you’re not alone—but by the end of this guide, you’ll understand why this overlooked stock split strategy deserves a place in your toolkit.

Real risk-free investing through quantitative research.

Key Takeaways

- RSA = Reverse Stock Arbitrage

- Capitalizes on brokers rounding up fractional shares after a reverse stock split.

- How it works: Buy 1 share before the split, get 1 full new share after due to rounding—profit instantly.

- Best brokers: Robinhood, Webull, Public, SoFi, dSPAC (each with quirks).

- Requires: 1 share per brokerage account, multiple accounts recommended for higher gains.

- Risk: Low cost per play, but account bans possible if abused.

What Is a Reverse Stock Split?

A reverse stock split is a corporate action where a company consolidates its existing shares into fewer, higher-priced shares. For example, in a 1-for-25 reverse split, 25 old shares are merged into 1 new share.

The overall value of the company doesn’t change, but the price per share increases, and the number of shares in circulation decreases.

This is often done to prevent delisting from exchanges like Nasdaq or the NYSE, which require stocks to trade above $1.00. Reverse splits may also aim to attract institutional investors or restructure a company’s capitalization.

However, they’re often seen as a sign of distress—used by companies whose share prices have dropped significantly.

Also known as: stock consolidation, share rollback, or stock merge.

What Is Reverse Stock Arbitrage (RSA)?

RSA is a clever strategy that takes advantage of how some brokers handle fractional shares during a reverse stock split.

When a reverse split happens, you might end up with a fraction of a share (like 1/25 of a new share). Some brokers will round that fraction up to 1 full share.

This rounding becomes profit. If you bought 1 share at $0.80, and the split is 1-for-25, your share becomes 1/25 of a new one—but your broker might round it up to 1 full share now worth ~$20. That’s an instant 24x return on a low-risk $0.80 buy-in.

Note: This only works once per account per split. Traders are known to open accounts across multiple brokers.

RSA vs Traditional Arbitrage

Unlike classic arbitrage (which involves buying an asset in one market and selling it in another), RSA is based entirely on internal broker mechanics and corporate events.

There’s no spread to exploit—just a one-time price jump created by rounding behavior.

- Traditional Arbitrage: Requires real-time price differences across exchanges.

- RSA: Requires patience, account control, and timing corporate actions.

RSA is best viewed as a tactical loophole—low risk, low entry cost, but limited per account.

Traditional arbitrage needs capital and speed; RSA just needs planning.

Which Brokers Support RSA? (Based on My Experience)

Here’s what I’ve learned personally using RSA with various platforms:

| Broker | RSA Support | Notes |

|---|---|---|

| Robinhood | ✅ | Easiest to use. 10–15 day delay to sell. |

| Webull | ✅ | Requires 100 shares for <$1 stocks. Use cash account. Keep ~$100 minimum. |

| Public | ✅ | Simple UI. $20 deposit. Next-day selling supported. |

| dSPAC | ✅ | App-only. Monthly fee possible. Works but can delay split reflection. |

| SoFi Invest | ⚠️ Limited | Few RSA opportunities. Good interface and next-day selling. |

| Schwab | ⚠️ Limited | Blocks some splits. Up to $1,000 bonus for new users. |

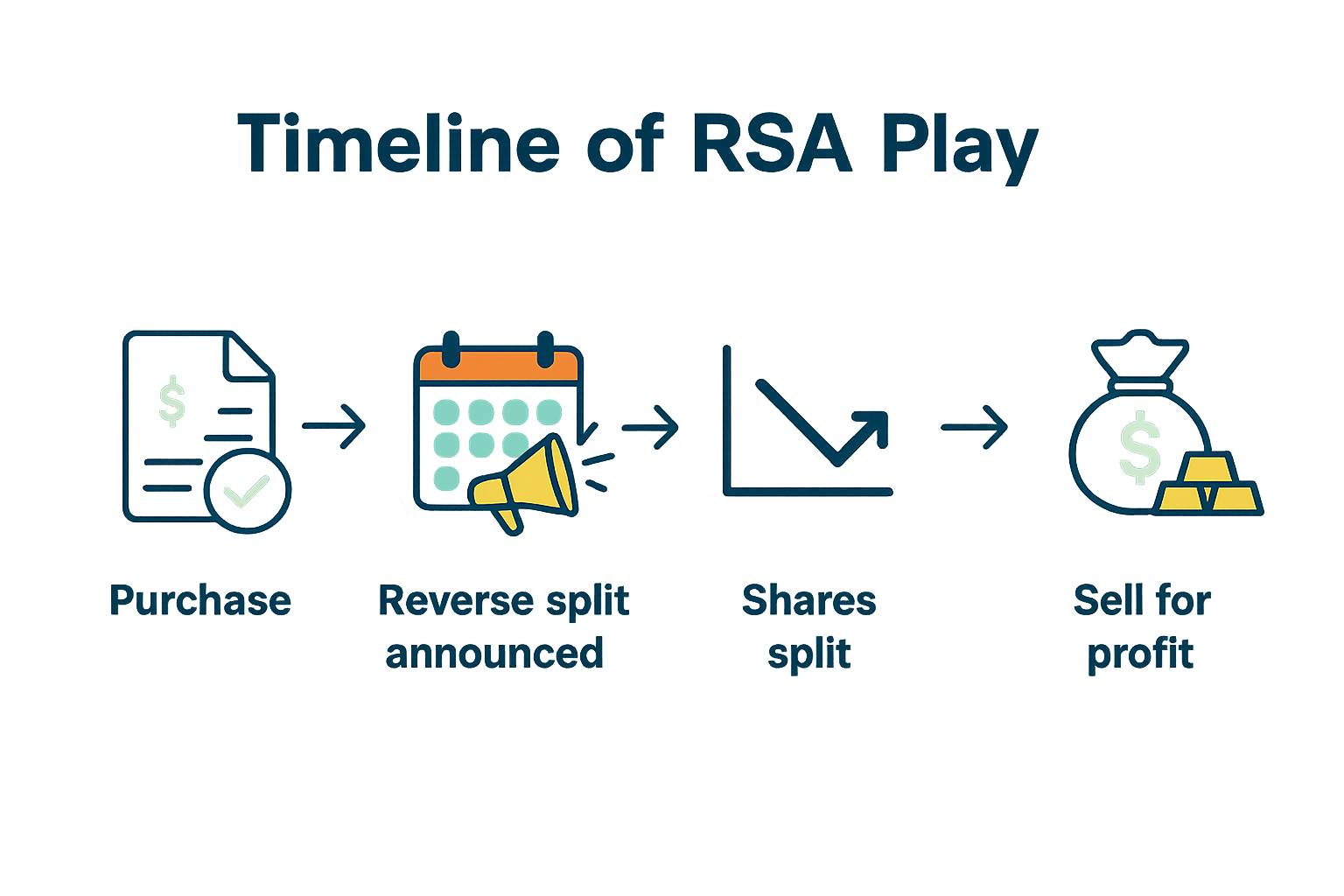

How to Execute an RSA Play

- Track upcoming reverse splits using broker tools or stock split calendars.

- Buy 1 share of the stock before the effective date.

- Wait for the corporate action to process.

- Check if the share was rounded up. If so, sell for profit.

Tip: Many advanced traders use spreadsheets or Google Sheets to track accounts and pending splits across brokers.

Hypothetical RSA Play Examples

| Ticker | Split Ratio | Old Price | New Price | Profit |

|---|---|---|---|---|

| $XYZ | 1-for-50 | $0.20 | $10.00 | $9.80 |

| $LMN | 1-for-25 | $0.80 | $20.00 | $19.20 |

Keep in mind, these results are PER ACCOUNT.

Risks, Bans, and My Advise

- Don’t contact support asking about rounding.

- Don’t open 50+ accounts with one broker—this gets flagged.

- Spread out accounts across brokers (4–10 is reasonable).

- Don’t withdraw too often. Withdraw monthly at most if doing this at scale.

🧠 Want to Try RSA Yourself?

- Start with Robinhood – Easiest and most RSA-friendly broker.

- Use Webull for advanced trades – Bonus cash and fractional share options.

- Public Investing – Fast execution and easy UI.

- Schwab Investing – Up to $1,000 bonus with limitations.

- Use a Chase Business Card – Earn rewards on funding transfers and brokerage activity.

Thanks for reading! We hope you found this helpful and educational. If it was useful, we'd appreciate if you shared it with others who might benefit. Feel free to explore more of our content!

Deviate Solutions - Nikolas V.

With a background in tech, digital strategy, and years of hands-on trading, I’ve been chasing entrepreneurship and financial freedom since a young age — and I’ve tried just about everything. Now, I simplify the complex to help you think differently about money, markets, and tools that actually work — all built on real experience. Failure’s part of the game. Let’s learn to win together.

Get In Touch