“There’s a package waiting.”

“Your toll is unpaid.”

“Verify your identity now.”

These messages hit millions of phones every week—and too many people are still falling for them.

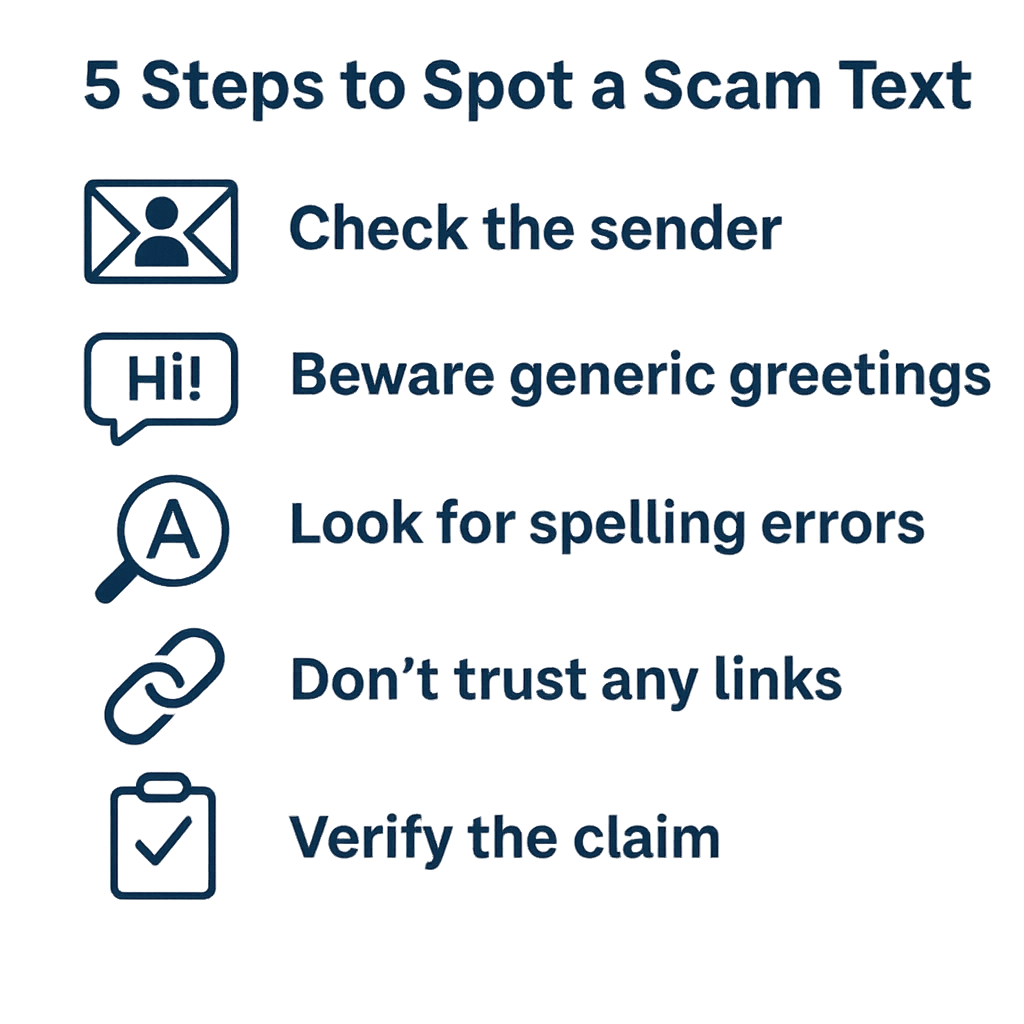

These scams are getting more advanced, but the core advice remains the same: if you didn’t start the conversation, don’t engage.

Delete the message, or take time to verify it yourself—never trust a link or number you didn’t ask for.

It’s worth noting that while banks in the U.S. are FDIC-insured, that protection only applies to certain types of bank failures—not scams where you’ve been tricked into authorizing a transaction.

More importantly, FDIC insurance doesn’t protect your identity.

Once your personal details are compromised, the damage can extend far beyond your bank account.

Key Takeaways

- Scam texts are often disguised as toll charges, delivery notifications, or urgent alerts from your bank or service providers.

- Replying, clicking, or calling back can expose you to phishing, malware, or financial theft.

- If the message wasn’t initiated by you, don’t trust it—delete it or verify independently.

- Report scam texts to your carrier by forwarding them to

7726, or report to the FTC.

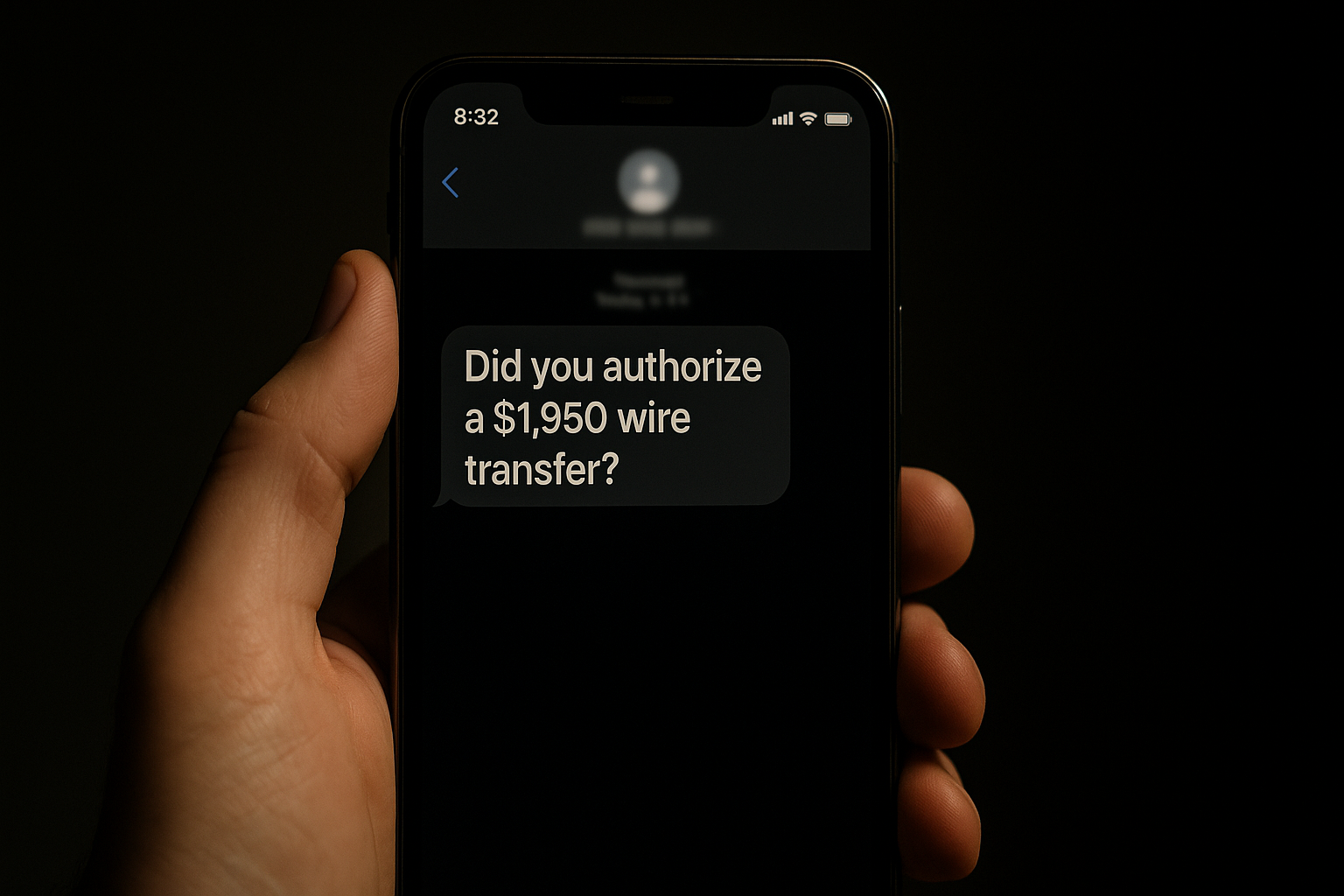

A college student lost nearly $10,000—almost their entire savings—after replying to what looked like a common fraud alert from their bank.

The text seemed urgent, flagging a suspicious charge. Moments after replying, their phone rang. The caller ID showed “Bank of America,” and the person on the line sounded calm, professional, and reassuring.

The scammer already had some of their personal info. They guided the student step-by-step, claiming it was a security check—when in reality, they were authorizing a wire transfer.

By the time they realized something was wrong, the money was gone.

Because the student had unknowingly approved the transaction themselves, the bank refused to reimburse the loss.

It was a painful lesson—and a reminder that anyone can be manipulated when the scam looks and sounds real.

Why These Texts Are So Convincing

Scammers prey on your instincts—urgency, fear, curiosity, and even greed in some cases.

- They impersonate trusted brands.

Scammers mimic names like USPS, Amazon, or your bank. They even spoof text threads to make it look like a real alert. - They create urgency.

Phrases like “Unpaid toll” or “Account locked” push you to act quickly—before you can think critically. - They look short and official.

Messages are designed to resemble real service texts: brief, structured, and with a clear call to action. - They use real data.

Some scams include your name, address, or partial account details from data breaches to appear more legitimate. - They follow up with spoofed calls.

Many victims receive a follow-up phone call that appears to come from a real company, complete with a spoofed or “fake” caller ID.

The texts are short, alarming, and designed to make you act fast without thinking.

That’s what makes them dangerous.

How Do Scammers Get Your Number?

Most scam texts aren’t random. Scammers often buy phone numbers in bulk from data breaches, shady lead generation firms, or the dark web.

In other cases, they use automated tools that guess combinations of digits based on common formats.

If you’ve ever entered your number into a sweepstakes, unsecured app, or fake login form, your contact info may already be circulating on lists shared or sold between fraud rings.

Common Scam Text Examples

- “Final Notice: Your toll is unpaid. Pay here to avoid penalties.”

- “USPS: We couldn’t deliver your package. Update address here.”

- “Your bank account has been locked. Verify your identity now.”

Rule of thumb: If the message wasn’t initiated by you—or you didn’t request verification—don’t reply. Don’t click. Don’t call. Instead, go directly to the official website or app and verify it yourself.

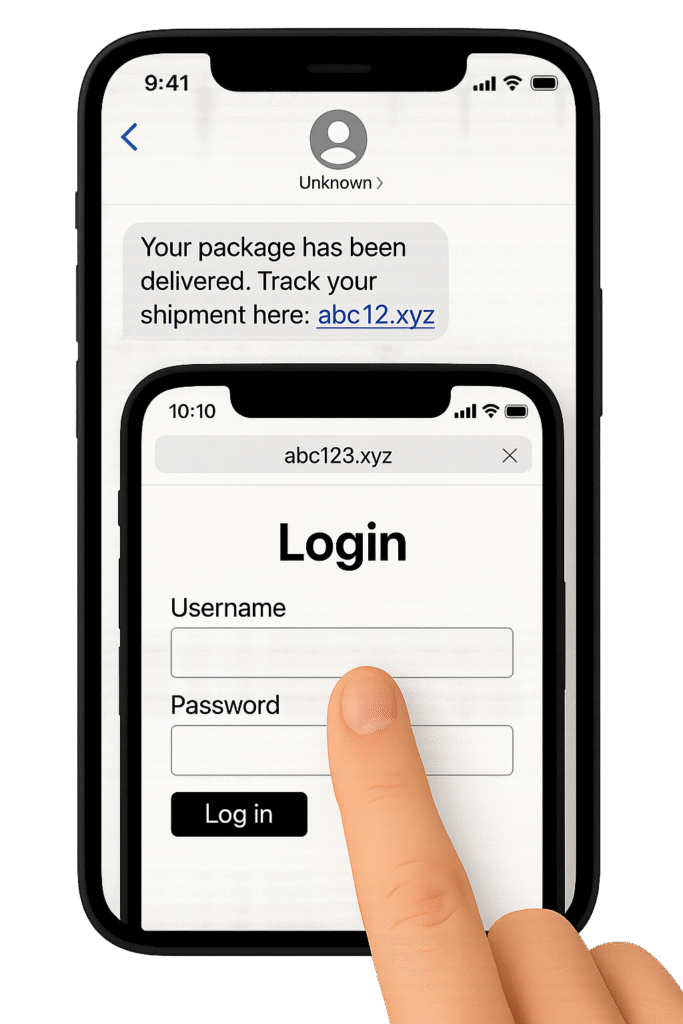

What Happens If You Click the Scam Link?

Here’s what you risk by clicking scam links:

- You may be taken to a fake login page that steals your credentials.

- You may fall victim to identity fraud.

- You might trigger a malware or spyware download.

- You could unknowingly enroll in premium SMS services or subscription charges.

Sometimes nothing obvious happens—but that doesn’t mean the site didn’t quietly collect your device info or prompt background downloads.

What to Do If You Clicked The Link

- Do not enter any information. Exit the browser immediately.

- Clear browser history and cookies. This helps remove trackers or saved sessions.

- Run a malware scan. Use built-in device security or a trusted antivirus app.

- Change any passwords you entered. Start with email or financial logins first.

Emerging Scam Trends to Watch Out For

- Chatbot scams: Scammers may send links to support chats that look real but are fully controlled by them.

- AI-generated texts and voices: Some scammers are using artificial intelligence to craft more convincing messages—or even mimic real voices in follow-up phone calls.

- Deepfake voicemails: A growing tactic where recorded audio sounds like someone you know or trust.

How to Report Scam Texts

- Forward the message to

7726(SPAM): Supported by most major U.S. carriers like Verizon, AT&T, and T-Mobile. - Report to the FTC: Submit details at reportfraud.ftc.gov.

- Block the number: While scammers rotate numbers frequently, blocking helps reduce exposure.

Frequently Asked Questions

Helpful Resources

- National Do Not Call Registry – Opt out of unsolicited sales calls and reduce telemarketing attempts. Free and supported by the FTC.

- ReportFraud.ftc.gov – Official U.S. government site to report scam texts, phishing attempts, or fraud.

- Have I Been Pwned – Check if your phone number or email has been exposed in a known data breach.

- FTC Guide to Recognizing Spam Texts – Learn how to identify, avoid, and report unwanted messages.

- USA.gov Scam Information Hub – Covers current scam trends and how to protect yourself across all communication channels.

Stay Smart. Stay Informed.

No text message should make you panic. If it feels urgent or threatening—pause.

These scams are designed to hijack your reaction time. The best thing you can do? Don’t answer.

Verify on your own terms. And if you’re ever unsure, assume it’s fake until proven otherwise.

One message can cost thousands. Don’t let it be yours.

Thanks for reading! If you found this helpful, like it, share it, and check out more of our content.