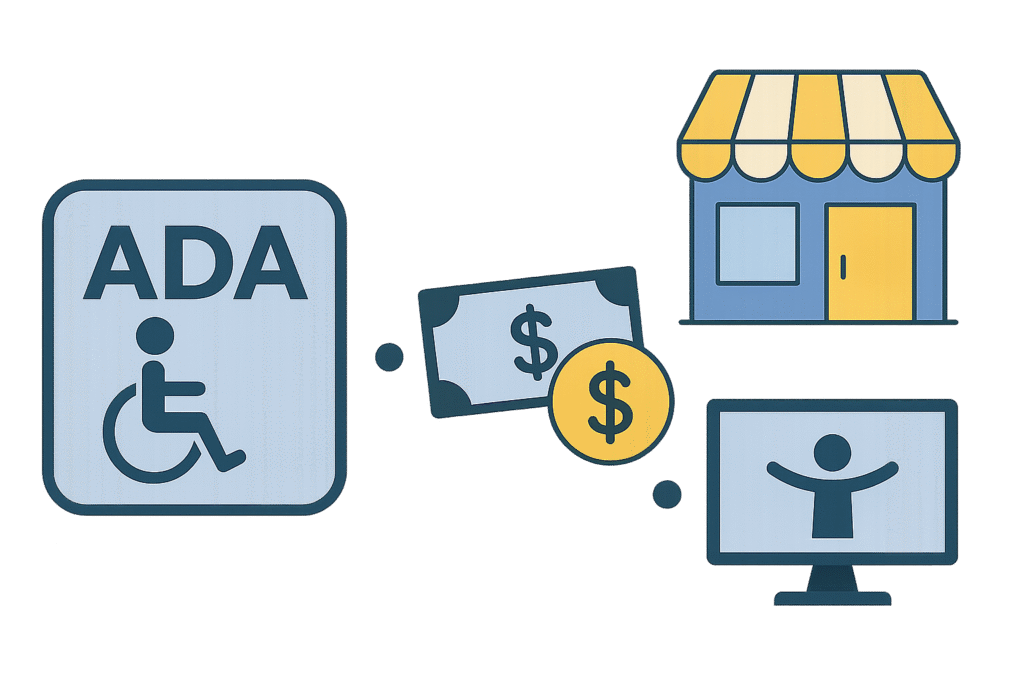

Making your business ADA-compliant is about more than just avoiding lawsuits; it’s about being inclusive of all and reaching a bigger audience, both digitally and physically.

From tax credits to long-term growth, accessibility is a business investment with measurable returns.

If your business is open to the public or has 15 or more employees, you’re legally required to follow ADA standards.

Small businesses can claim up to $5,000 in tax credits annually.

Non-compliance risks lawsuits and reputation damage.

Accessibility overlaps with SEO and improves usability.

Freelancers and agencies offer low-cost accessibility audits.

What Is ADA Accessibility?

The Americans with Disabilities Act (ADA), signed into law in 1990, prohibits discrimination against individuals with disabilities.

For businesses, that means ensuring your physical locations and digital platforms are accessible to people with a range of needs — from mobility to vision, hearing, and cognitive differences.

Compliance typically includes things like wheelchair ramps, accessible restrooms, appropriate signage, and websites that work well with assistive technologies.

But in practice, almost every business benefits from making its spaces and experiences more inclusive.

Who Needs to Be ADA Compliant?

ADA compliance isn’t just for government buildings or major corporations. Here’s a breakdown of who should take accessibility seriously:

Professional offices — doctors, lawyers, accountants, therapists

Service providers — delivery, logistics, cleaning, construction

Freelancers and consultants — if you have a website or workspace

Digital service providers — apps, software, online tools

ADA lawsuits have extended into the digital space — and businesses of all sizes, including sole proprietors, are being held accountable.

Common Accessibility Mistakes Businesses Make

Many accessibility issues go unnoticed until they lead to complaints or legal threats. Here are common oversights that can cost you:

Poor color contrast that makes content unreadable

Missing captions or transcripts for videos and podcasts

Websites that can’t be navigated without a mouse

Restrooms that don’t meet spacing or fixture height standards

Missing wheelchair ramps or accessible parking

Narrow doorways and blocked pathways

Small fixes can go a long way — and many of them are eligible for federal tax relief.

ADA Tax Credits and Deductions

The IRS provides two key incentives for businesses making ADA-compliant upgrades.

Credit amount: 50% of qualifying expenses

Maximum benefit: Up to $5,000 annually

Expense limit: Up to $10,250 in costs per year

Covers: Physical and digital improvements

Deduction amount: Up to $15,000 per year

Focus: Architectural and transportation barriers

Bonus: Can combine with credit (different expenses)

Example: Deduct construction, credit for digital

You may be able to claim both incentives in the same year, just not on the same expenses.

For example, you might deduct construction work while using the credit for digital accessibility.

How to Qualify and Apply for ADA Tax Benefits

To qualify for ADA tax credits or deductions, your business must meet basic eligibility criteria, including:

Expenses directly tied to improving accessibility

Documentation of purchases or services (invoices, receipts, contracts)

Clear itemization of accessibility expenses for tax reporting

Consult your accountant or tax preparer to determine if costs qualify and whether to file Form 8826 or use the deduction route.

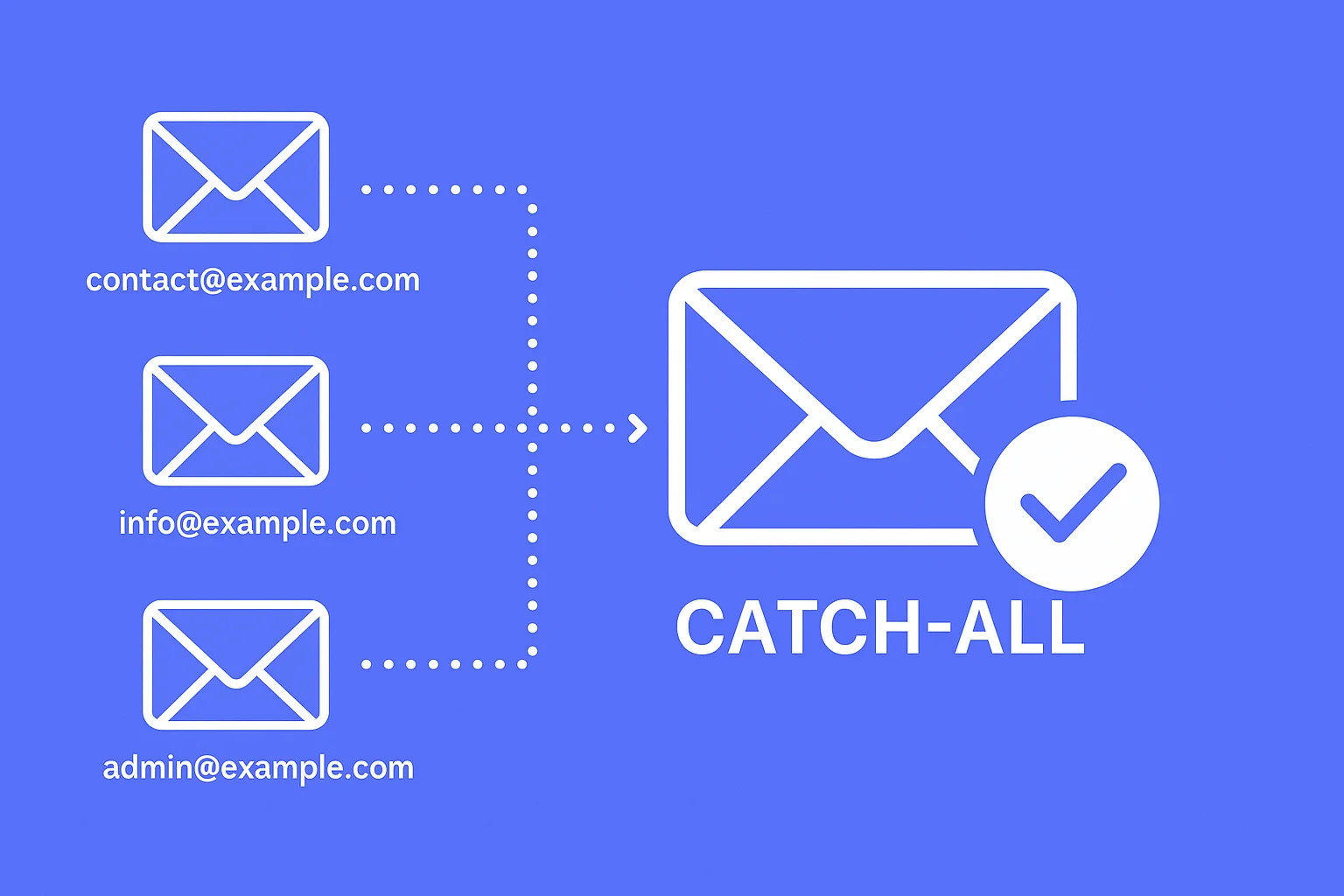

ADA Website Compliance Matters

ADA rules don’t stop at your storefront. Today, many lawsuits involve websites that lack support for users with visual, auditory, or motor impairments.

These are typically filed under Title III of the ADA, which covers public accommodations.

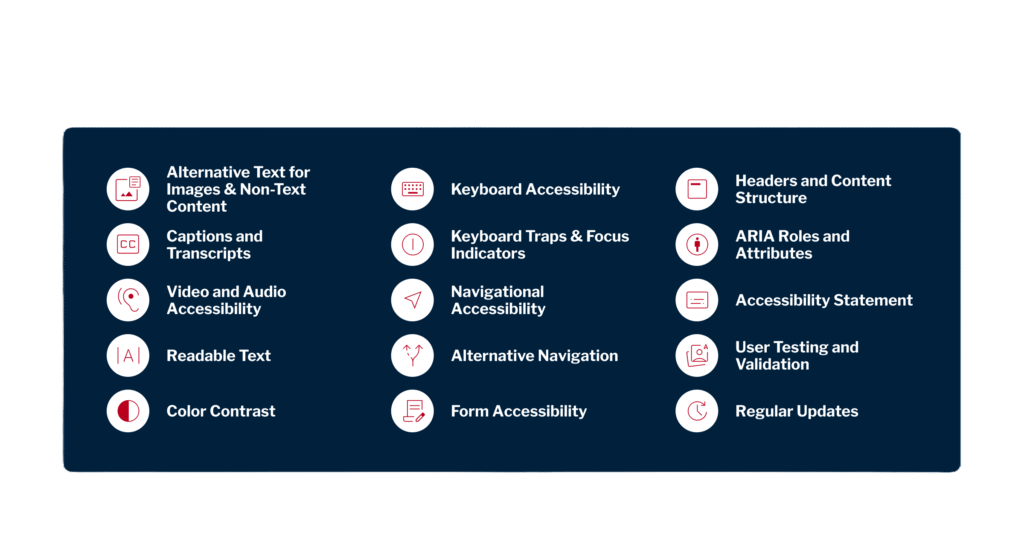

What makes a website ADA compliant? It should follow WCAG 2.1 guidelines, which include, but not limited to:

Readable font sizes and color contrast

Captioning or transcripts for multimedia

Proper use of HTML headers and structure

Screen reader-friendly design

Logical tab order and focus indicators

Skip navigation links for efficiency

If your site isn’t accessible, you’re potentially at risk of a lawsuit, but more importantly, you’re excluding users who rely on assistive tools to navigate the web.

Need Help? Hire an Expert on Fiverr

Many small businesses don’t have the budget or in-house skills to make websites ADA compliant.

Fortunately, you can hire verified freelancers on platforms like Fiverr Marketplace who specialize in:

Fixes for mobile, desktop, and ecommerce sites

Adding alt tags, structure markup, and keyboard navigation

Post-audit verification and documentation

Cost: Most services start under $100

Some also offer post-audit verification, which can be helpful in documenting your efforts and showing good faith if legal issues arise.

Most services start under $100, making them cost-effective — especially when paired with the ADA tax credit.

Accessibility Brings More Than Just Tax Breaks

While the financial incentive is valuable, ADA compliance creates a ripple effect across your business:

Higher Conversions – Easier navigation improves engagement and sales

Brand Loyalty – Inclusive brands gain long-term advocates

Mobile Compatibility – Accessibility often improves mobile experience

Operational Readiness – Prepares you for growth and scale

Making your content and services usable by more people isn’t just ethical — it’s a long-term business strategy.

Accessibility also aligns with general best practices for SEO, web usability, and mobile responsiveness.

Tip: Many accessibility improvements overlap with other key areas — including site speed, mobile compatibility, and user retention. Start with a free website scan from WAVE or hire a Fiverr accessibility expert for a full audit.

ADA Planning for Different Types of Businesses

Whether you’re running a storefront, building a service brand, or operating entirely online, accessibility applies.

Digital needs: Online menus, ordering systems, store locators

Special considerations: Multiple format menus, delivery accessibility

Digital needs: Patient portals, appointment booking, forms

Special considerations: Visual/audio cues, communication aids

Key elements: Alt text, captions, keyboard navigation

Testing: Regular accessibility audits and user testing

Document needs: Accessible contracts, proposals, reports

Communication: Email formatting, video call accessibility

Small Businesses Benefit from Accessibility

ADA compliance is more than a legal checkbox — it’s a smart business move.

From tax incentives and SEO benefits to improved customer trust, the advantages of accessibility reach far beyond the surface.

Start small, document your improvements, and make use of the resources available to you — including tax credits and freelance experts who can help you get it done quickly and affordably.

For businesses looking to implement these improvements cost-effectively, platforms like Fiverr offer access to specialized professionals who can handle everything from accessibility audits to complete website overhauls.

The discounts and credits mentioned here may change or expire. If a specific credit is unavailable, your investment in accessibility still pays off by improving reach, usability, and legal protection for years to come.

Frequently Asked Questions

Thanks for reading! If you found this helpful, like it, share it, and check out more of our content.

Helpful Resources

Thanks for reading!

If you found this helpful, like it, share it, and check out more of our content.

About The Author

Nikolas V.

Deviate Solutions LLC

I’ve spent years navigating computer science, digital marketing, business development, and day trading; chasing entrepreneurship and independence. Now I help businesses grow and expand through the latest technology and industry strategies. With all I learn and experience, I use my platform to break down complex insights so you can think differently about technology, your business, and your finances. Everything I share comes from real experience and plenty of trying and failing. Failure is part of the game. Always take the shot, Let’s learn to win together.

Get In Touch